That feeling in your stomach when the audit notice arrives. You know the one. It is a mix of dread and a sudden urge to re-check every piece of paper you have ever filed. An upcoming LIHTC onsite file audit can feel overwhelming, but solid preparation is your best tool for a successful outcome.

A well-managed audit process protects your tax credits and supports your property’s long-term financial stability. It is an opportunity to refine your procedures and strengthen your team. This guide will walk you through preparing for your next LIHTC audit with confidence.

Table Of Contents:

- What Exactly is a LIHTC Onsite File Audit?

- Your Step-by-Step LIHTC Onsite File Audit Prep Plan

- The Ultimate Tenant File Checklist for Texas LIHTC Audits

- Common Mistakes Found During Audits (and How to Avoid Them)

- The Day of the Audit: What to Expect

- After the Audit: Handling the Findings

- Conclusion

What Exactly is a LIHTC Onsite File Audit?

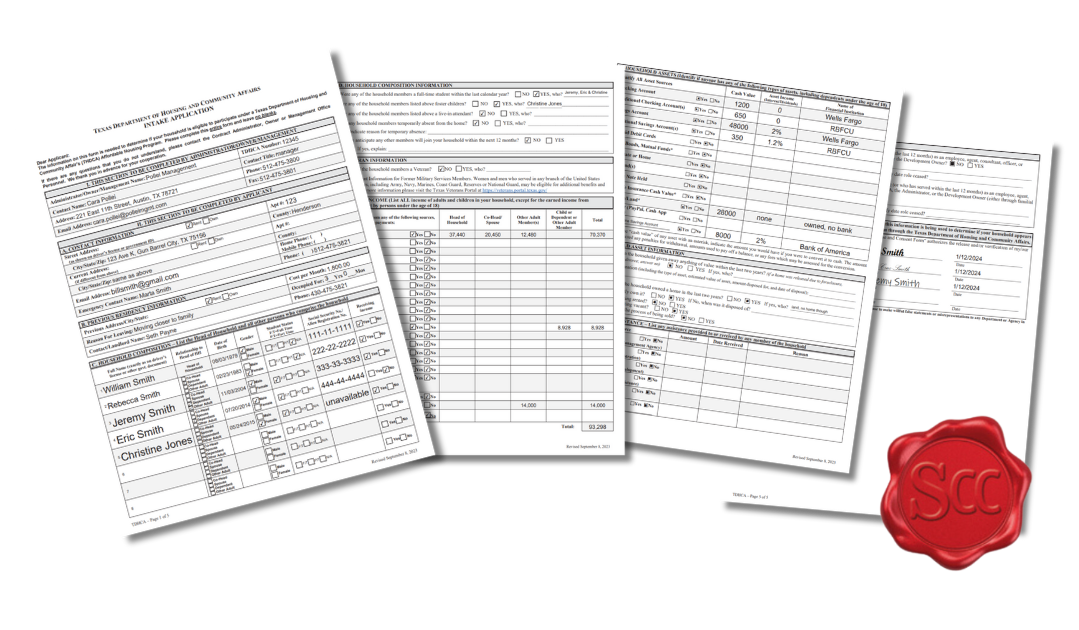

Think of it as a health check for your property’s compliance with the Low-Income Housing Tax Credit (LIHTC) program. A state housing finance agency, like the Texas Department of Housing and Community Affairs (TDHCA), sends an auditor to your property. Their job is to review your resident files and records to make sure you are following all the rules of this critical affordable housing program.

The main goal is to confirm that you are renting to qualified low-income households according to the program requirements set by the IRS and your state’s specific allocation plans. Auditors look at everything from the initial tenant application to the annual tenant income certifications. They want to see proof that your property management team has performed its due diligence correctly and maintains excellent record keeping.

This compliance monitoring is not punitive; it is a required part of the LIHTC program. It protects the federal investment in affordable housing and ensures that the housing serves its intended population. A clean audit demonstrates your commitment to housing compliance and responsible operation of your LIHTC properties.

So, What Are Auditors Looking For?

Auditors have a detailed checklist and a deep knowledge of the LIHTC program. They review Tenant Income Certifications (TICs) for accuracy, timeliness, and completeness. They verify that your rent limit and income limits are correct for your specific project and are updated annually.

They will check your math on every rent calculation and all income sources verified for each household. They will also look for supporting documents for all sources of income and assets. It is about having the documentation to back up every decision made for each LIHTC tenant and their household.

Here is a breakdown of key areas an auditor will focus on during tenant file reviews:

| Compliance Area | What Auditors Check |

|---|---|

| Tenant Application | Is the tenant application fully completed and signed by all adult household members? Are all questions answered? |

| Income Verification | Are all sources of tenant income identified and verified using acceptable methods? Is the income calculation correct and annualized properly? |

| Asset Verification | Have all assets been disclosed and verified? Is the income from assets correctly calculated and included in the total household income? |

| Student Status | Is the student status of every household member documented correctly? If students are present, do they meet one of the five exceptions to the student rule? Has financial aid verified? |

| Tenant Income Certification (TIC) | Is the TIC accurate, complete, and signed by both the tenant and the property manager? Was it completed before the move-in date? |

| Rent Calculation | Is the tenant’s rent at or below the maximum allowable rent limit for the unit size, income designation, and program? Each program calculates slightly different when it comes to including rental assistance |

| Utility Allowance | Are you using the correct, current utility allowance for your property? Is it being applied correctly in the rent calculation? |

| Lease Agreement | Does the lease contain the required LIHTC language and addenda? Are the dates and rent amounts consistent with the TIC? |

Your Step-by-Step LIHTC Onsite File Audit Prep Plan

Okay, deep breath. You can get through this with a good action plan. The moment that notice arrives, it is time to get organized, not panic. Let’s walk through the steps together for complete audit readiness.

Step 1: Review the Notification Letter Immediately

This letter is your game plan, so do not just glance at it and set it aside. Read every single word carefully, as it contains essential information about the scope of the file review. This document from the housing finance agency outlines everything you need to know to prepare.

The letter will tell you the number of units they will look at and if it is an in person audit or desk review (virtual) anticipated date and time of the audit, whether or not they will also conduct a physical inspection at the same time. The letter will also let you know what pre audit documentation you will need to submit prior to the audit and where and how to submit it. This information helps you focus your energy where it matters most.

Step 2: Assemble Your A-Team

This is not a one-person job; successful property management relies on teamwork. You need to pull your team together, including your property manager, compliance specialist, and any leasing staff who handle paperwork. Everyone involved in your public housing or affordable housing operations should be aware of the upcoming review.

Everyone needs to understand their role in the audit process. Who will be the main point of contact for the auditor? Who is responsible for pulling the files and making sure they are complete with all required forms? A quick team meeting with some basic compliance training can assign tasks and make the whole process run better.

Step 3: Conduct a Pre-Audit Internal Review

Review your own files before the auditor does. Regular quarterly spot check of the files is at the heart of the “audit-ready method”. The goal is to do this regularly so when you get the notice you do not have to scramble to review all your files in a short period of time. This proactive approach also shows the state finance agency that you are serious about compliance standards.

Gather a few files at random to get a broad picture of your records. Pretend you are the auditor and review tenant files with a critical eye, checking against a comprehensive checklist. This internal tenant file audit will highlight any areas that need corrective action before the official review begins.

The Ultimate Tenant File Checklist for Texas LIHTC Audits

Having a consistent file order saves everyone time and shows the auditor you are organized. A clean LIHTC file is easier to review and creates a strong impression. Every tenant file for your LIHTC properties should contain the same documents in the same order.

Here’s a more detailed rundown of what should be in every single file for LIHTC projects:

- A complete and signed application for every adult household member. This is the foundation of the file.

- All income verification forms, such as pay stubs, 3rd party employment verification, or benefit letters (pay stubs and benefit letters are also referred to as source documentation).

- All assets must be documented and if they exceed the current asset limitation threshold, they should also be verified via 3rd party verification or source documentation.

- A current Tenant Income Certification (TIC) signed by all adult household members and management.

- Proof of student status for all household members, if applicable, along with documentation of any exceptions. Also include verification of financial aid for any students in the household regardless of FT or PT status.

- A copy of the fully executed lease agreement and any relevant addendums, like VAWA or house rules.

- The move-in inspection form signed by both you and the resident, documenting the unit’s condition.

- Annual recertification paperwork, including new income certifications and verifications.

- Documentation related to your tenant selection plan, showing how the household was selected from the waitlist.

You can find many of the required Texas-specific forms directly on the TDHCA website, which is an invaluable resource center. Using the correct, up-to-date forms as dictated by the state’s qualified allocation plans is absolutely critical for housing compliance. Failure to do so is one of the most common pitfalls.

Common Mistakes Found During Audits (and How to Avoid Them)

Over the years, the same common LIHTC compliance issues come up again and again. The good news is that most of them are easy to prevent with proper training and procedures. You just have to know what to look for before the audit begins.

Missing or Incomplete Paperwork

This is probably the most frequent finding during file audits. A missing signature on a form, an unchecked box on a student questionnaire, or an undated document can lead to a compliance issue. It sounds small, but it shows a gap in your process and can call other parts of the file into question.

The fix is simple but takes discipline. Use a file checklist for every single move-in and recertification. Have a second person, like a compliance specialist or a trained property manager, review the file before it is put away to catch any small mistakes.

Incorrect Income Calculations

Income calculation errors can cause major problems that impact your low-income housing tax credit. They could lead to you renting a unit to an over-income household, which is a significant finding that can jeopardize tax credits. Understanding what counts as tenant income is crucial.

Always double-check your math, especially when annualizing income from various sources. It is a good idea to have a clear understanding of IRS guidelines and any state-specific rules. Resources like Novogradac’s LIHTC Compliance Guidance can also help. Using compliance software can help, but you still need to understand how it reaches its conclusions to explain it to an auditor.

File Organization Issues

Imagine an auditor sitting down to a messy, disorganized pile of papers. It immediately sets a bad tone for the LIHTC audit. They have limited time, and a chaotic file makes their job of conducting file reviews much harder and more time-consuming.

This is an easy win for your team. Keep all your resident files in a consistent order, using tabs and dividers to make it simple for anyone to find a specific document quickly. Good record keeping reflects well on your entire operation and your commitment to affordable housing compliance.

The Day of the Audit: What to Expect

When the auditor from the finance agency arrives, your preparation will pay off. Your calm and professional attitude will set the stage for a productive day. Welcome them and show them to the space you have prepared for the tenant file audit.

This space should be quiet, clean, and comfortable. Make sure there is a table, good lighting, and access to a power outlet. When they give you the list of units, pull them quickly and neatly stack them for them to review. Do not try to review the file at this time, which shows respect for their time and your level of organization.

The audit usually starts with an entrance interview. The auditor will explain the process and ask some general questions about your property and your procedures. Just be honest and direct with your answers, providing clear information about your operations.

After the interview, they will begin the file review. Try not to hover, but let them know you are available to answer any questions. At the end of the day, they may conduct a brief exit interview to discuss any initial thoughts or potential findings before they issue a formal report.

After the Audit: Handling the Findings

So, what if the auditor does find some issues? First, do not panic. Getting a finding or two is common, especially with complex LIHTC requirements, and it is not a sign of failure. It is an opportunity to improve your operations and strengthen your compliance protocols.

You will receive a formal report detailing any findings of non-compliance issues. The report will give you a deadline to respond, which you must meet. Your response must include a detailed corrective action plan. Here in Texas the letters also include options for correcting the finding which is particularly helpful.

This plan explains how you have fixed the specific issue and what steps you will take to make sure it does not happen again. For additional context, see IRS guidance on Form 8823. Be specific and thorough in your response with clear corrective actions. This is where getting expert help, like services from Sanchez Compliance, with a file review can really pay off, helping your response satisfy the agency’s requirements and protect your property and future credits long-term.

Conclusion

An audit is just one part of managing an affordable housing property. With the right systems in place, it becomes a routine check-up instead of a major crisis. Continuous preparation, compliance training, and internal reviews are your best strategy to face any LIHTC onsite file audit with confidence.

Thinking this way protects your assets and lets you focus on your real mission: giving quality housing to your residents. Facing a file audit doesn’t have to derail your work. It can make your team stronger, your processes better, and reinforce your commitment to the LIHTC program.

If you’re looking at an audit notice and feeling that stress, let’s talk. Our expert File Review services catch issues before the auditor does. Contact us today to build your own “Always Be Audit-Ready” plan.